September 04, 2023

•

3 min read

Navigating September's Financial Waters

How the S&P 500 and global events may shape the coming weeks

The Historical Pattern

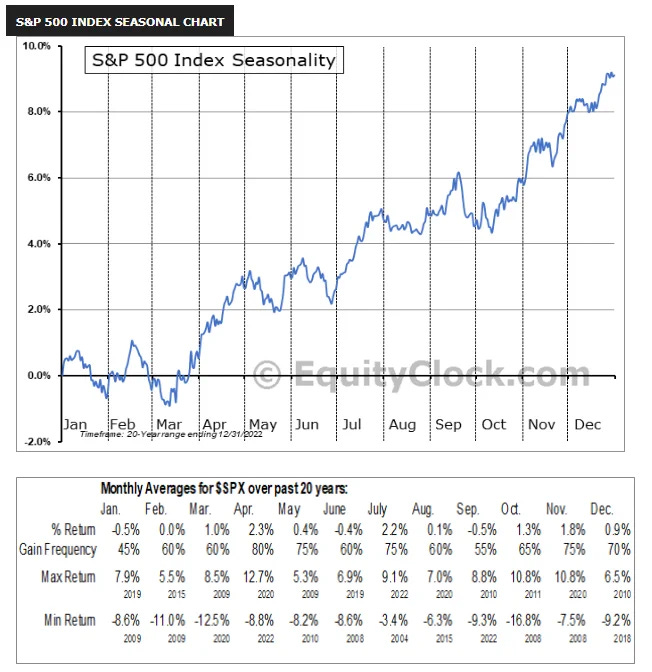

As we draw nearer to September, it's essential to remember that this month has historically been one of the S&P 500's weakest. Couple this with the quarterly OpEx, and you've got the makings for heightened volatility.

Eyes on China

This month, the spotlight turns to the East. Growing concerns about the world's second-largest economy have led to increased calls for intervention by Chinese authorities. The expected moves and decisions here will undeniably influence global financial dynamics.

A Tentative Upcoming Week

Although we predict the forthcoming week to be relatively placid, expect a choppy ride. The global markets are on tenterhooks, continuously trying to deduce the Federal Reserve's imminent policy decisions. They're making these judgments through indications from both Canada and Australia. One crucial point to note: The market isn't reacting negatively to bad data, suggesting that it’s still grappling with choosing a definitive direction.

The Vanna & Charm Dynamics

Prepare to witness the return of the Vanna & Charm effects over the next fortnight. These mechanisms are likely to shield markets from severe downside fluctuations. This protective layer comes as market makers initiate the process of buying back their short put and short stock hedges.

In the Financial Weeds

For those who thrive on the nitty-gritty, here’s something to ponder: The reverse repo operation closed the week at $1.574T, showing a $220B decrease from the preceding week. This change is a clear indication of an increase in system liquidity. Equally notable is the SPX option matrix data. It reveals an addition of $480B of gamma exposure for September, hinting at potential market movements.

Key Events For Next Week

Tuesday:

China Caixin Services PMI

Australia RBA meeting

Wednesday:

Canada BOC meeting

US ISM Services

US Fed's Beige Book

Thursday:

China trade data (Imports/Exports/Trade Balance)

Eurozone Q2 GDP

US Unit Labor Cost

---

Stay tuned with Feedback.io for more insights and market analyses.