August 12, 2023

•

5 min read

Inflation in the US: A Deep Dive into Recent Data

latest inflation figures and their implications on monetary policies

US Inflation Data Unveiled

Yesterday, the US released its latest inflation figures, aligning closely with analysts' predictions. The all-encompassing annual figure, or headline CPI, has risen from 3.0% to 3.2%. However, this increase can be attributed to base effects and doesn't necessarily signal a crisis.

Comparatively, last July's monthly figure was slightly more favorable, standing at 0% in 2022 as opposed to 0.2% in 2023. Still, the latter remains satisfactory. Nick Timiraos, a prominent economic reporter from the Wall Street Journal, ran some calculations. Factoring in the monthly figures over the last three or six months, he determined an annualized CPI of 1.9% for the past three months and 2.6% for the past six. He insightfully captioned this finding as “the summer of disinflation continues,” with disinflation indicating a decline in inflation.

Impact on the Federal Reserve’s Strategy

The high-interest rate is reportedly dampening the economy, as noted by the central bank. Some experts speculate that the Fed's stringent measures could inadvertently tip the economy into an unnecessary recession.

In a recent press conference following an interest rate decision, Fed Chairman Jerome Powell emphasized that once inflation is undoubtedly under control, the Fed would consider adjusting the interest rate to a neutral level – neither restraining nor stimulating. More details can be explored in Alpha Markets.

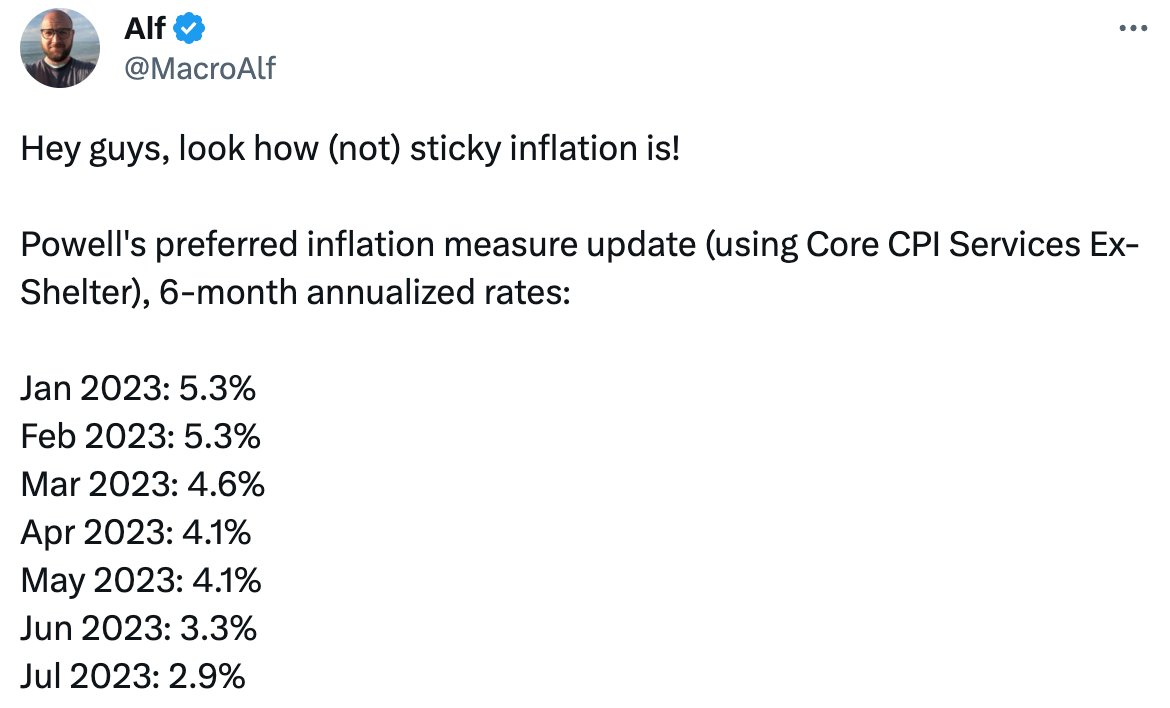

Typically, the Fed relies on a specific form of core inflation for these decisions. This type excludes volatile components like energy and food and even some services. Currently, this figure is on a decline, as highlighted in a tweet by Alfonso Peccatiello.

The Fed's Focus & Challenges Ahead

Will the Federal Reserve solely rely on this core figure? A plausible scenario could arise where core inflation decreases steadily, but the overall figure remains elevated, possibly influenced by surges in oil and gas prices.

A paramount issue for the Fed (and other central banks) is upholding or restoring their credibility, which has been under immense scrutiny. Past dismissals of potential inflation as ‘transitory’ (US) and ‘just a little hump’ (EU) in 2021 have not helped their cause. It was only when inflation soared uncontrollably that central banks recalibrated their stance and reacted assertively. The IMF aptly summarized the situation: 'Central banks need to raise interest rates to tame inflation and preserve their credibility.'

Many speculate that central banks might maintain high-interest rates longer than economically advisable. Both the CPI and unemployment are lagging indicators of the business cycle, causing banks to react based on past data. This could prompt governments to introduce more support and investment programs, leaning more towards fiscal stimulus than monetary stimulus.

Furthermore, the current high-interest rates inadvertently boost economies where significant public debt is held majorly by the private sector, like in the US and some European nations. Such interest serves as additional income for savers and bondholders.

Looking Ahead

There's potential for the following outcomes:

1. Over the next nine months, the economy might gradually recover from its current downturn. The earliest data series are showing positive signs. If unemployment worsens (being a lagging indicator), governments might intervene with more stimulative measures.

2. Due to high-interest rates and quantitative tightening (QT), certain sectors, including real estate, financial institutions, and SMEs, might face challenges.

It wouldn't be surprising if 2024 starts with an upswing in the business cycle, encouraging investors to embrace riskier assets, expansive government stimulation programs, and central bank rate reductions. This could be a triple advantage for risk assets like tech stocks and bitcoin. However, these factors might also be laying the groundwork for another massive inflation wave, potentially arriving around 2025/2026.